Notes from the Assessor: Tax Bills

We would like to provide clarity and some additional information now that tax bills have been sent out and our Assessors have been receiving numerous questions in the days since.

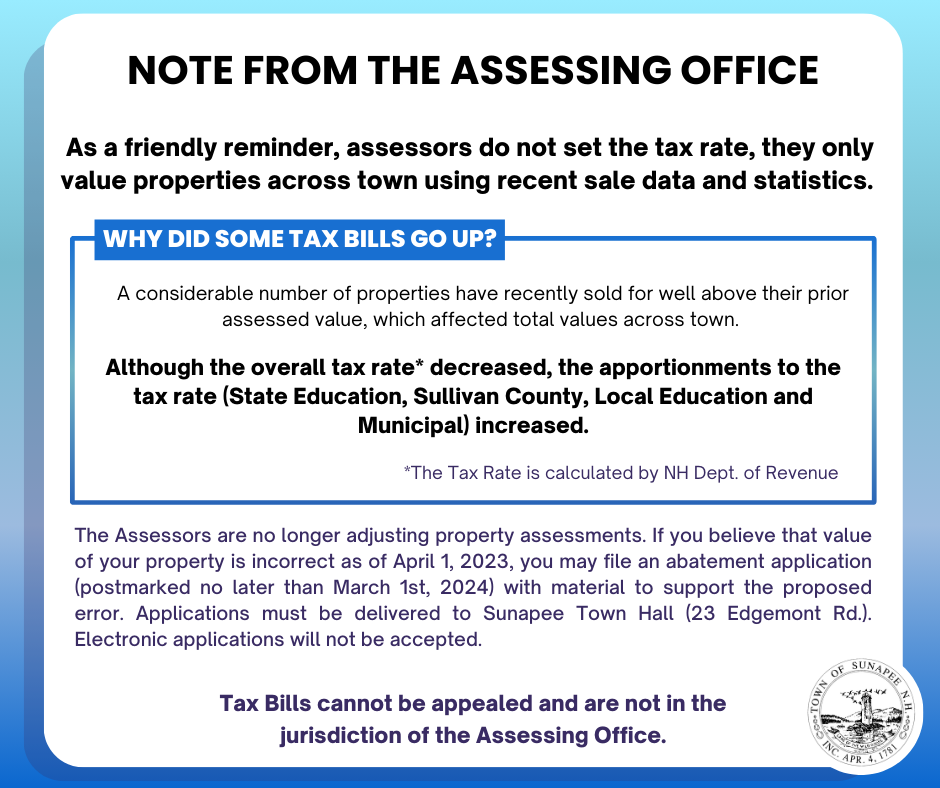

1) The Assessors do NOT calculate taxes, they only value properties across town using recent sale data and statistics. The Tax Rate is calculated by NH Dept. of Revenue.

2) Although the overall tax rate decreased, the apportionments to the tax rate (State Education, Sullivan County, Local Education, and Municipal) increased.

3) The Assessors are no longer adjusting property assessments. If you believe that value of your property is incorrect as of April 1, 2023, you may file an abatement (postmarked no later than March 1st, 2024), with material to support the proposed error. No electronic applications will be accepted. Abatement applications are available on our Assessing Department website: https://www.town.sunapee.nh.us/assessing/pages/property-abatements-appeals

Applications must be delivered to Sunapee Town Hall (23 Edgemont Rd.). Electronic applications will not be accepted.

The following video discusses the role of Assessors and why revaluation is important to maintaining fairness and equity across neighborhoods and property types: https://youtu.be/3WJV5Prj0PY?si=LeFydjsPX2BCauQ6